Requesting a VAT number

Do you sell your products on international Marketplaces? Make sure you have your VAT matters in order!

Why do I need a VAT number?

As an online seller, VAT matters may not be the first thing on your mind, or something you want to think about. However, it’s important to timely file your VAT returns and pay your VAT. After all, you wouldn’t want a blocked sales account or a fine arriving in the mail, right? Especially when selling across borders, dealing with VAT returns and registrations in different countries can be quite a maze of rules.

Example: Selling on Amazon.de.

Do you want to sell your products on Amazon.de? Simply selling in Germany may be covered by the One Stop Shop (OSS) scheme. However, if you also want to use Fulfilment by Amazon and store your inventory in Germany, you’re required to have a German VAT number.

Applying for a German VAT number doesn’t have to be difficult. Together with our Marketplace Partner Staxxer, we ensure that you are fully VAT-compliant!

How does the process of requesting a VAT number work?

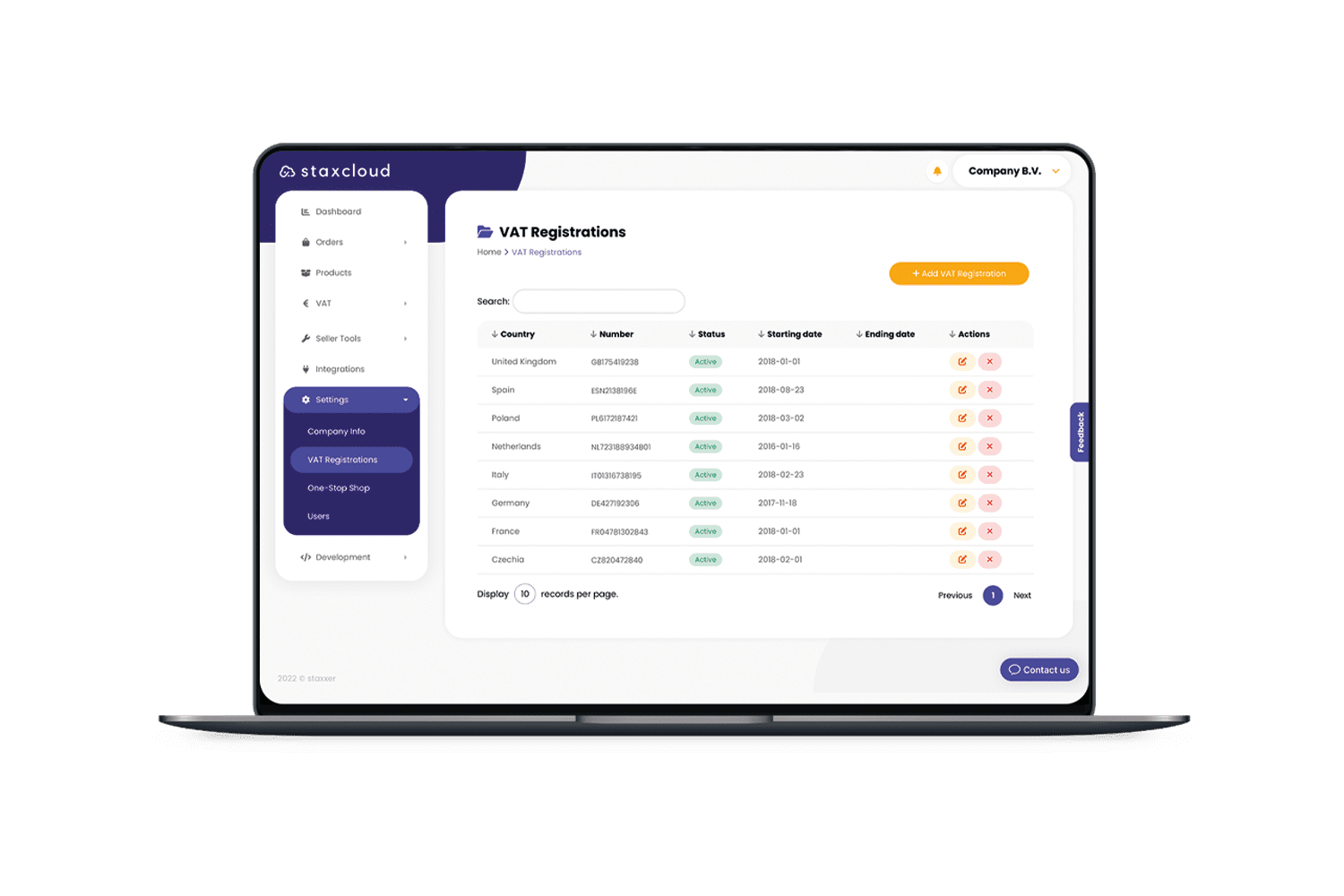

Our Marketplace Partner Staxxer can assist you with both obtaining a VAT number and filing returns within Europe. Together, we assess the best possible solution for your organization.

Interested in using the One Stop Shop scheme? They can also handle this application for you. Staxxer has assembled a team of top European tax experts specializing in e-commerce.

We can apply for a VAT number in a EU country of your choice starting from a rate of €279,-. Your application will be sent out the same day!

Good to know: Are you selling via Amazon? We can also apply for a PAN-European VAT number for you.

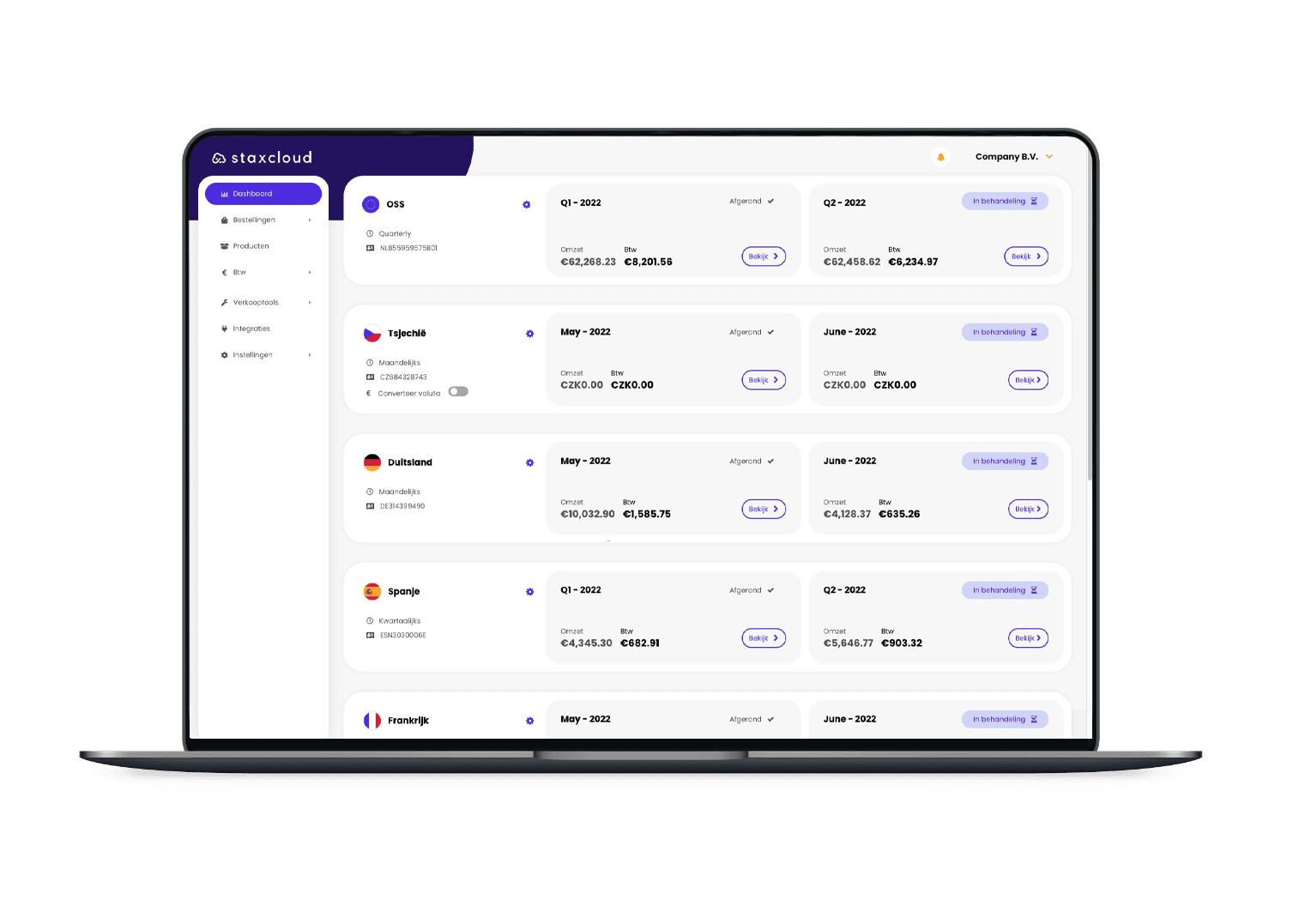

Filing VAT Returns – Easy and Fast

Simply obtaining a VAT number doesn’t fulfill all requirements. You’re also obligated to file periodic VAT returns. Would you like to outsource your VAT returns as well? That’s possible starting from €69,- per VAT return. The One Stop Shop service is available for €179,-.

Are you also interested in one of the following offers?

- 50% discount on VAT number registrations

- Free One Stop Shop registration + 3 months of free OSS returns

- 3 months of free VAT returns in one EU country

Claim now through the link below:

https://staxxer.com/product/mpexpert/

Ready to apply for a VAT number?

Looking to scale internationally? Ensure that you meet all VAT requirements. Our partner Staxxer takes care of you where needed, even if you already have an accountant! Staxxer works seamlessly alongside them.